LIMA, Ohio (WLIO) – Time is running out for Allen County residents to pay their second-half real estate and mobile home taxes.

The Allen County Treasurer’s Office reminds taxpayers that the deadline to pay is Friday, July 11, by midnight. Treasurer Krista Bohn is urging residents to pay what they can, even if they’re unable to pay the full amount, and to contact the office to make arrangements. Ignoring the payment altogether, she warns, will result in immediate and escalating penalties.

“If you don't pay by that point, it's going to roll forward into the next year, and that's when you start getting interest charged on those delinquent charges,” Bohn said. “However, once you're about 18 months delinquent and you have been posted in the newspaper, which also happens after we do that delinquent billing cycle, then you are eligible for foreclosure.”

A 10-percent penalty is applied immediately after the deadline, with additional penalties and interest accruing over time.

There are several options available for making tax payments:

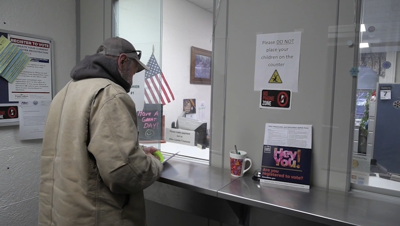

In-person at the Treasurer’s Office, located in the Allen County Courthouse, open until 4:30 p.m.

At Allen County Branches, Superior Credit Union and Union Bank (tax bill payment stub required).

By mail, postmarked by July 11 via the U.S. Postal Service.

Drop box, located at the front entrance of the courthouse, by midnight on July 11.

Online or by phone using a credit card or e-check (small service fee applies).

Residents with questions can call the Treasurer’s Office at 419-223-8515.