ALLEN COUNTY, OHIO (WLIO) — Real estate taxes and mobile home tax payments in Allen County are due February 14.

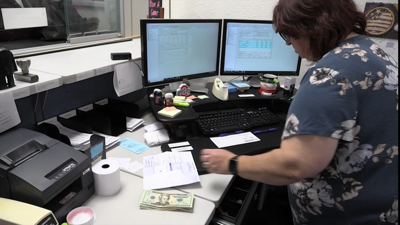

First-half taxes must be paid by the deadline to avoid a 10% penalty. The Allen County Treasurer’s Office encourages residents to use its online tax portal to access important information about their property. The portal lists previous years’ tax amounts, payment status from lenders, and more.

“You can also see if your payment has been posted,” said Allen County Treasurer Krista Bohn. “A lot of people call us just to verify that we've received their check and processed their payment. So you can see all of that information on there, along with seeing what the second half amount is if you've already paid your first half and want to budget and plan for that July payment.”

Payments can be made in several ways: in person at the Treasurer’s Office, at any Allen County branch of Superior Credit Union or Union Bank, or online. A drop box is also available outside the Allen County Courthouse. For those mailing payments, they must be postmarked by Friday to avoid a penalty.

If you haven’t received your bill yet, the Treasurer’s Office advises calling for assistance at (419) 223-8515. Additional details are available on the Treasurer’s website or at hometownstations.com.