LOGAN COUNTY, OH (WLIO) - The U.S. Small Business Administration is offering low-interest disaster loans for the people affected by the March 14th tornado outbreak.

These loans are available to businesses and residents of the counties that were part of the Presidential Disaster Declaration that was made earlier this month. That includes Logan, Auglaize, Mercer, and Hancock counties in our area.

Businesses and non-profits are allowed to borrow up to 2 million dollars to repair or replace real estate, equipment, and other business assets. Homeowners can get up to $500,000 for destroyed or damaged real estate and up to $100,000 for damaged or destroyed personal property. Interest rates are 4% for businesses, 3.25% for nonprofits, and 2.68% for homeowners and renters, with terms of up to 30 years.

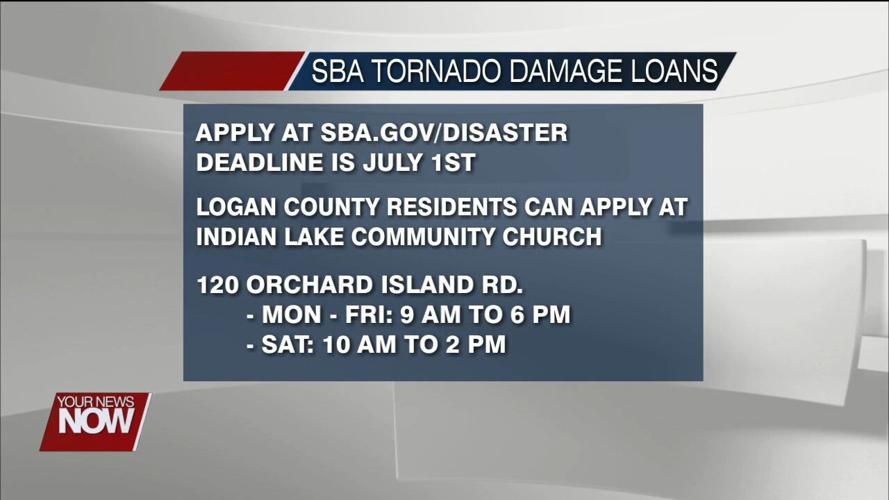

You can apply for these loans online at sba.gov/disaster, and Logan County residents can do so at the Indian Lake Community Church. The deadline to apply is July 1, 2024.

May 7, 2024, Press Release from the U.S. Small Business Administration (SBA): WASHINGTON – Low-interest disaster loans from the U.S. Small Business Administration (SBA) are available to businesses and residents in Ohio following the announcement of a Presidential disaster declaration due to tornadoes that occurred on March 14.

“SBA’s mission-driven team stands ready to help Ohio small businesses and residents impacted by this disaster in every way possible under President Biden’s disaster declaration for certain affected areas,” said SBA Administrator Isabel Casillas Guzman. “We’re committed to providing federal disaster loans swiftly and efficiently, with a customer-centric approach to help businesses and communities recover and rebuild.”

The disaster declaration covers Auglaize, Crawford, Darke, Delaware, Hancock, Licking, Logan, Mercer, Miami, Richland and Union counties in Ohio, which are eligible for both Physical and Economic Injury Disaster Loans from the SBA. Small businesses and most private nonprofit organizations in the following adjacent counties are eligible to apply only for SBA Economic Injury Disaster Loans (EIDLs): Allen, Ashland, Champaign, Clark, Coshocton, Fairfield, Franklin, Hardin, Henry, Huron, Knox, Madison, Marion, Montgomery, Morrow, Muskingum, Perry, Preble, Putnam, Seneca, Shelby, VanWert, Wood and Wyandot in Ohio; and Adams, Jay, Wayne and Randolph in Indiana.

Disaster survivors should not wait to settle with their insurance company before applying for a disaster loan. If a survivor does not know how much of their loss will be covered by insurance or other sources, SBA can make a low-interest disaster loan for the total loss up to its loan limits, provided the borrower agrees to use insurance proceeds to reduce or repay the loan.

Customer Service Representatives at SBA’s Business Recovery Center will assist business owners complete their disaster loan application, accept documents for existing applications, and provide updates on an application’s status. The Center will operate as indicated below until further notice:

| Business Recovery Center Logan County Indian Lake Community Church Russells Point, Ohio 43348 Opening: Tuesday, May 7 at 11 a.m. to 6 p.m. Hours: Monday - Friday, 9 a.m. to 6 p.m. Saturday, 10 a.m. to 2 p.m. Closed: Sunday |

Businesses and private nonprofit organizations of any size may borrow up to $2 million to repair or replace disaster-damaged or destroyed real estate, machinery and equipment, inventory, and other business assets.

For small businesses, small agricultural cooperatives, small businesses engaged in aquaculture and most private nonprofit organizations, the SBA offers Economic Injury Disaster Loans (EIDLs) to help meet working capital needs caused by the disaster. Economic Injury Disaster Loan assistance is available regardless of whether the business suffered any physical property damage.

Disaster loans up to $500,000 are available to homeowners to repair or replace disaster-damaged or destroyed real estate. Homeowners and renters are eligible for up to $100,000 to repair or replace disaster damaged or destroyed personal property.

Interest rates are as low as 4% for businesses, 3.25% for nonprofit organizations, and 2.688% for homeowners and renters, with terms of up to 30 years. Interest does not begin to accrue, and monthly payments are not due, until 12 months from the date of the initial disbursement. Loan amounts and terms are set by the SBA and are based on each applicant’s financial condition.

Building back smarter and stronger can be an effective recovery tool for future disasters. Applicants may be eligible for a loan amount increase of up to 20% of their physical damages, as verified by the SBA for mitigation purposes. Eligible mitigation improvements may include a safe room or storm shelter, sump pump, French drain or retaining wall to help protect property and occupants from future disasters.

“The opportunity to include measures to help prevent future damage from occurring is a significant benefit of SBA’s disaster loan program,” said Francisco Sánchez, Jr., associate administrator for the Office of Disaster Recovery and Resilience at the Small Business Administration. “I encourage everyone to consult their contractors and emergency management mitigation specialists for ideas and apply for an SBA disaster loan increase for funding.”

Applicants may apply online and receive additional disaster assistance information at SBA.gov/disaster. Applicants may also call SBA’s Customer Service Center at (800) 659-2955 or email disastercustomerservice@sba.gov for more information on SBA disaster assistance. For people who are deaf, hard of hearing, or have a speech disability, please dial 7-1-1 to access telecommunications relay services.

The filing deadline to return applications for physical property damage is July 1, 2024. The deadline to return economic injury applications is Feb. 3, 2025.