LIMA, Ohio (WLIO) - The Lima City Schools Finance Committee met Tuesday night to discuss the district’s financial future.

According to Lima City Schools Treasurer Heather Sharp, the post-COVID-19 era is forcing the district to transition expenses previously covered by federal pandemic funds back into the general fund.

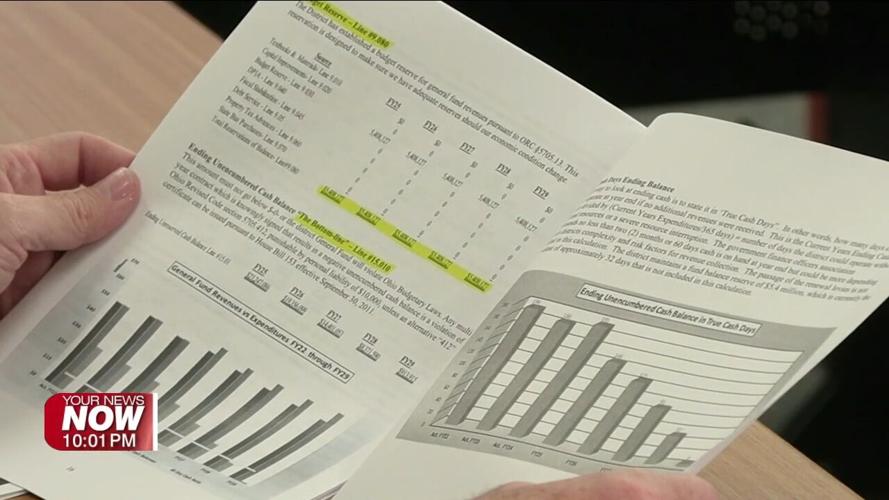

According to Lima City Schools Treasurer Heather Sharp, the post-COVID-19 era is forcing the district to transition expenses previously covered by federal pandemic funds back into the general fund. Sharp also reported that the district has been deficit spending since fiscal year 2022. As a result, Lima City Schools is anticipating a $4.8 million deficit this year and a projected $3.7 million deficit for fiscal year 2026. To address this, the district plans to place a renewal levy on the ballot in November.

“We rely heavily on the levies,” says Heather Sharp, Treasurer, Lima City Schools. ”We are anticipating on putting a renewal levy, so no new money, out in November. We're just hopeful that the district or the community sees the need for that so we can move forward continuing to educate our kids and do all those things but still have the funds to be able to provide.”

Lima City Schools is also considering the creation of two additional funds — one for severance and another for capital planning. Another financial concern for the district centers around the state’s biennial operating budget, known as House Bill 96. Sharp said the bill would limit the amount of funds districts can carry over, which could put Lima City Schools under financial strain.

“House Bill 96, which is the operating budget, which would limit a school district's ability to have any carryover over 30%. That puts us in a real, real financial bind if that happens, as many districts in Ohio are going to be over that. Right now, Lima City is sitting about 65%, so that would be very detrimental to us,” Sharp explains.

Sharp added the district will be closely monitoring House Bill 96, as the Ohio Senate has sent it back to the House for further review of the carryover limit provision.

Sharp added the district will be closely monitoring House Bill 96, as the Ohio Senate has sent it back to the House for further review of the carryover limit provision. She also noted that the district is tracking 14 pieces of pending property tax reform legislation that could impact school finances.