The Allen County Auditor wants to make sure eligible homeowners understand tax savings programs available to them.

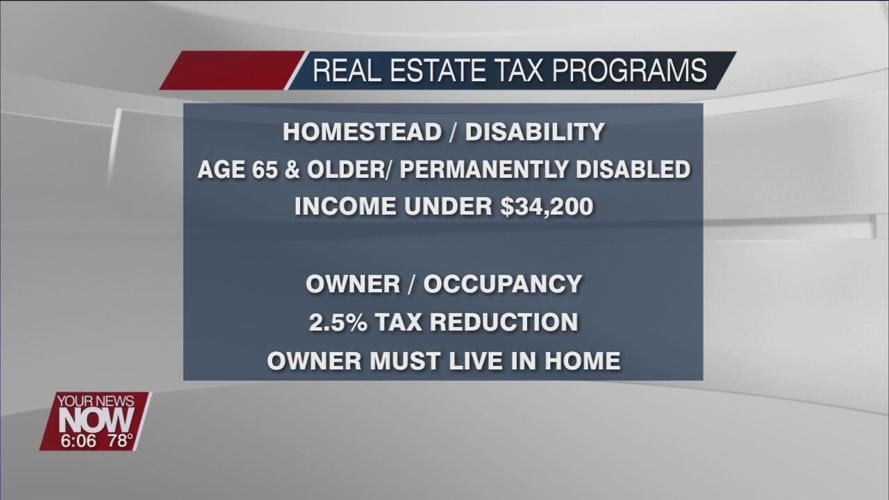

The State of Ohio offers several reduction programs through the county auditor’s office that can save hundreds in tax monies. The Homestead Exemption program is for anyone 65 years and older and any permanently disabled individuals under 65. You must own your own home and have an income under $34,200. The Owner Occupancy program offers a 2.5% reduction in property taxes for a home occupied by the owner. These programs do not happen automatically you have to apply to get them.

Allen County Auditor Rachael Gilroy explains, “It doesn’t cost anyone to apply, and if your applicable, it’s a very simple process. It’s a one-page application that we can help you fill out. It’s very simple. And while it’s not an exciting type of thing to think about, once you realize the savings that you just realized on your taxes, then that makes a big difference to a lot of people.”

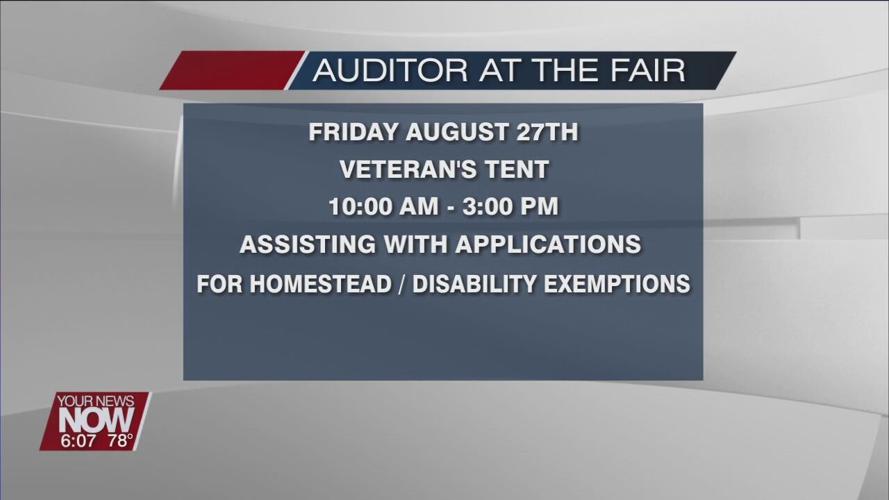

Gilroy has assigned a second staff member to help identify qualifying individuals with applications. They also encourage veterans to see if they qualify and will be at the fairgrounds next Friday at the veteran’s tent at the fair with application forms from 10 a.m. to 3 p.m.