ALLEN COUNTY, OH (WLIO) - The State of Ohio is making some changes to the Homestead Exemption Tax that will benefit many Ohioans.

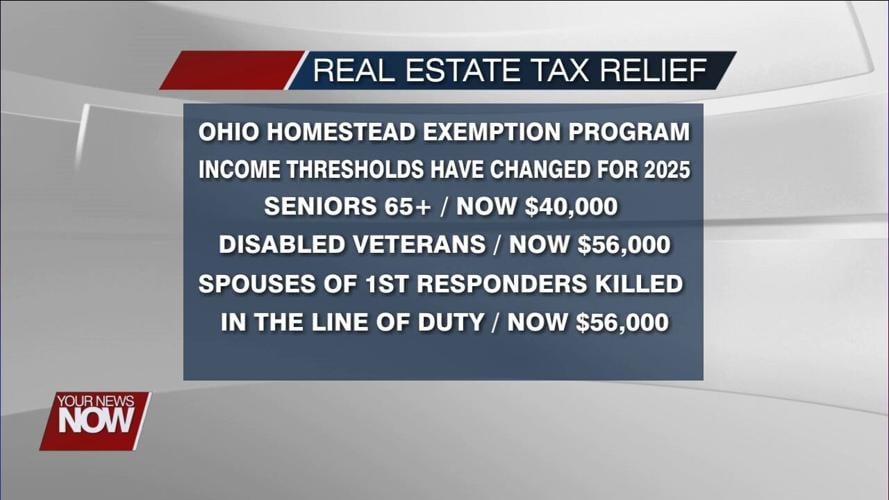

The Allen County auditor released that new income thresholds have been established for seniors 65 years of age or older, disabled veterans, and spouses of first responders killed in the line of duty.

The Allen County auditor released that new income thresholds have been established for seniors 65 years of age or older, disabled veterans, and spouses of first responders killed in the line of duty. The amounts adjust with inflation annually, and properties have a new market value because of the new triennial.

"From that market value, we're able to deduct $28,000 of property value right off the top. And then, that 35% assessed value is taken from that number. So their market value, only for tax purposes, is essentially coming down to a more manageable rate," explained Rachael Gilroy, Allen County Auditor.

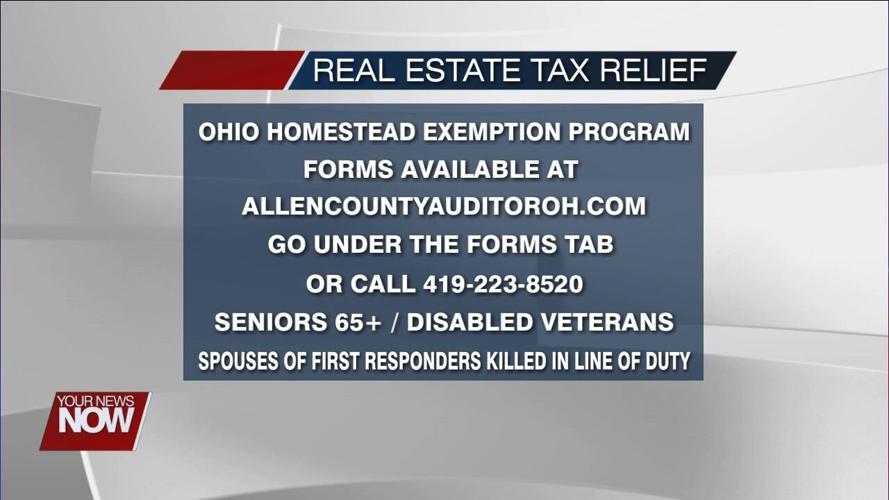

You can go onto the Allen County auditor's website at https://allencountyohauditor.com/ to find the forms.

You can go onto the Allen County auditor's website at https://allencountyohauditor.com/ to find the forms to fill out to see if you are eligible for the Homestead Exemption Tax.